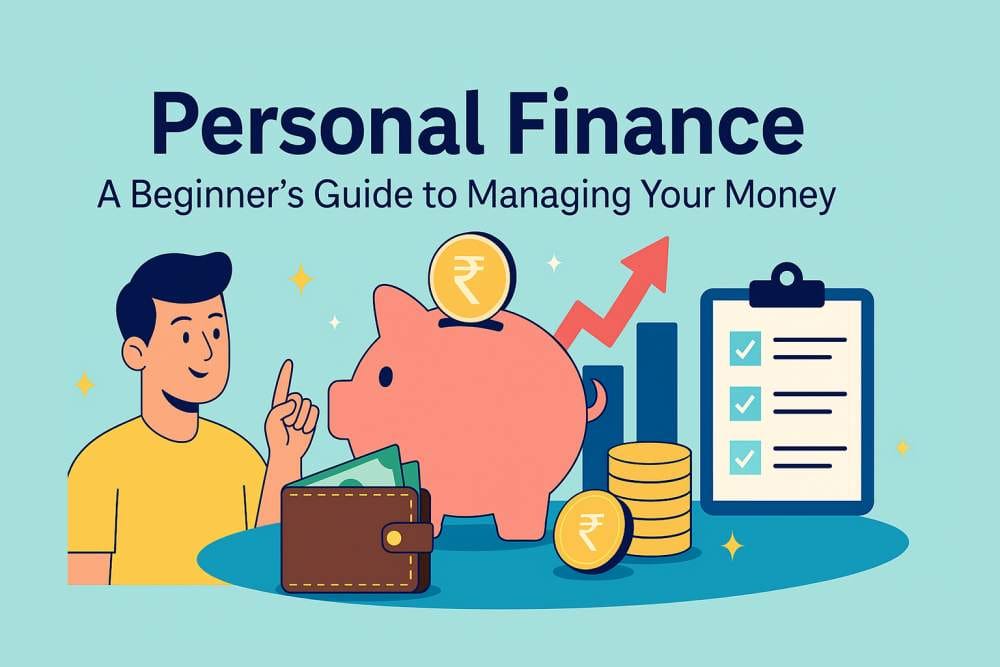

“Money isn’t everything, but everything needs money.” – Anonymous

If the idea of checking your bank balance makes you break into a cold sweat, you’re not alone. Personal finance can feel daunting—but it doesn’t have to. With the right tools, mindset, and a bit of planning, you can transform financial stress into confidence and control.

📊 What Is Personal Finance?

Personal finance is how you earn, budget, save, invest, and protect your money to meet life goals. It covers:

- Income management (salary, side hustles)

- Expense tracking (bills, groceries)

- Savings & emergency funds

- Investments (mutual funds, stocks)

- Debt management (loans, credit cards)

- Insurance & retirement planning

“Learning to manage your money is like learning to ride a bicycle. The sooner you start, the better you ride.”

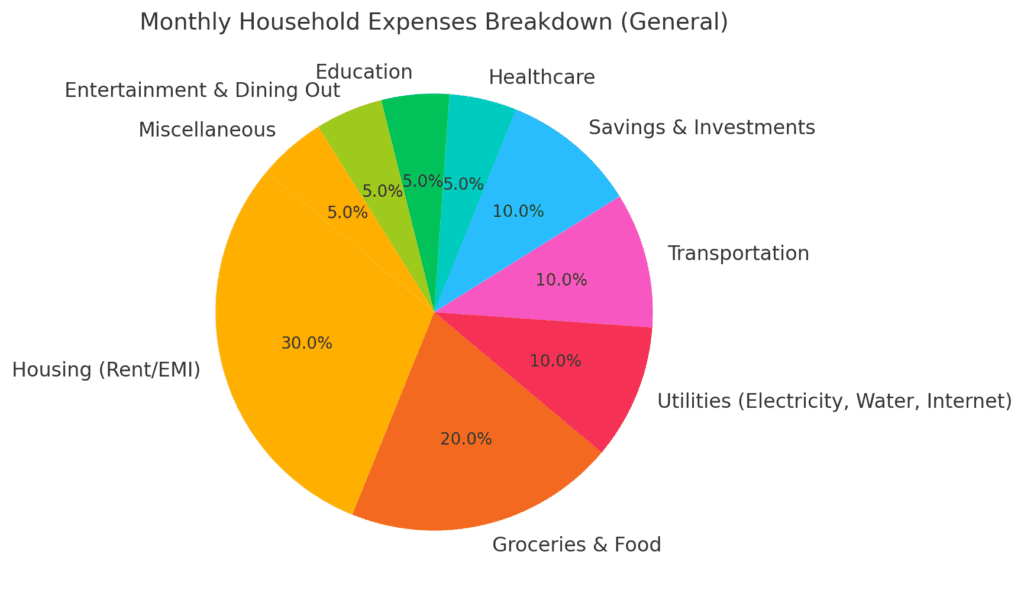

🔍 Budgeting Basics: Your Financial Roadmap

A budget is your financial GPS. It tells every rupee where to go. According to Investopedia, budgeting helps you:

- Avoid overspending

- Build savings

- Plan for goals

Budgeting Methods Compared

| Method | How It Works | Best For |

|---|---|---|

| 50/30/20 Rule | 50% needs, 30% wants, 20% savings/investments | Beginners seeking simplicity |

| Envelope System | Cash for each category in labeled envelopes | Those who overspend on cards |

| Zero-Based Budget | Assign every rupee a job until income minus expenses = 0 | Detail-oriented planners |

| Kakeibo (Japanese) | Monthly journaling of income & expenses | Mindful spenders & habit builders |

Find more on budgeting in our first-salary guide

🏦 Building Your Emergency Fund

Life is unpredictable. An emergency fund of 3–6 months’ expenses shields you from sudden job loss or medical bills. Start small:

- Open a high-yield savings account (e.g., RBI‑backed banks).

- Automate

5–10%of income each month. - Celebrate milestones—₹10,000, ₹25,000, and so on.

Pro Tip: Treat it like a recurring “bill” you can’t skip.

📈 Investing for Beginners

Once your budget and safety net are set, let your money grow. Investing isn’t gambling—think of it as planting seeds that flourish over time.

- Mutual Funds (SIPs): Low-cost, diversified portfolios.

- Index Funds: Track market indices, minimal fees.

- Stocks: Higher risk, higher reward—start small and research.

According to a Morningstar report, SIP investments have grown at an annualized rate of 12–15% over the past decade.

“Compounding is the eighth wonder of the world.” – Albert Einstein

💳 Managing & Avoiding Bad Debt

Debt can be a tool—if used wisely. But credit-card balances and payday loans trap you in high interest.

- Good Debt: Home loans, education loans (low rates, long terms).

- Bad Debt: High‑interest credit cards, personal loans for non‑essentials.

Strategies to eliminate bad debt:

- Snowball Method: Pay smallest balance first.

- Avalanche Method: Pay highest interest rate first.

- Balance Transfer: Move debt to 0% interest card temporarily.

🧰 Essential Financial Tools & Apps

Technology makes managing money easier. Here are our top picks for 2025:

- Walnut (Expense Tracker) – Automatic expense categorization.

- Groww / Zerodha (Investing) – Simple SIP and stock trading.

- Monefy (Budgeting App) – User‑friendly, cross‑device sync.

- Cred (Credit Score) – Track & improve credit health.

Insider Tip: Set daily or weekly reminders to review these apps—consistency is key.

🌱 Personalizing Your Financial Plan

No two journeys are alike. Customize by:

- Setting SMART Goals (Specific, Measurable, Achievable, Relevant, Time‑bound).

- Reviewing Quarterly—adjust for raises, new expenses.

- Incorporating Values—charity giving, ethical investing, family priorities.

“A goal without a plan is just a wish.” – Antoine de Saint‑Exupéry

📚 Further Reading & Resources

🤝 Internal Links to Grow Your Knowledge

- How to Create Your First Budget

- Emergency Fund Planning 101

- Mutual Funds vs Stocks

🚀 Ready to Take Control?

Managing your money is a journey, not a destination. The earlier you start, the more freedom you gain. Share your biggest personal finance challenge in the comments below or subscribe for weekly finance tips straight to your inbox! ✉️

Call-to-Action (CTA):

💡 Join our newsletter for exclusive budget templates, investment checklists, and expert Q&As—click “Subscribe” now and take your first step toward financial freedom!

📢 Disclaimer: “Money Advisor is operated by a SEBI-registered Mutual Fund Distributor (ARN-129675). The content on this blog is for informational purposes only and should not be considered as investment advice. Mutual Fund investments are subject to market risks. Please read all scheme-related documents carefully.”

Pingback: Why Most Indians Fail at Financial Planning? How You Can Win?