We all are have a question in our mind that how IMF works? In the world of global finance, the International Monetary Fund (IMF) plays a critical role in stabilizing economies and supporting countries facing financial distress. One such country that has frequently turned to the IMF for help is Pakistan. In recent months, the IMF approved a significant loan package to Pakistan to help it address its mounting economic challenges.

In this blog post, we’ll dive deep into:

- The recent IMF loan approval to Pakistan

- How the IMF functions

- How it gets the funds to lend to countries like Pakistan

- What this means for developing economies and global financial stability

1. IMF Approves a Fresh Loan to Pakistan

In 2024–2025, the IMF approved a $3 billion standby arrangement (SBA) for Pakistan, disbursing part of the funds immediately with the rest tied to Pakistan meeting specific economic reforms. The package was aimed at helping Pakistan stabilize its currency, restore confidence in public finances, and implement much-needed structural reforms to revive growth and fight inflation.

This wasn’t the first time Pakistan sought IMF support. In fact, it has turned to the IMF over 20 times since its independence — one of the highest among all nations — signaling persistent economic challenges ranging from poor fiscal management to external account deficits.

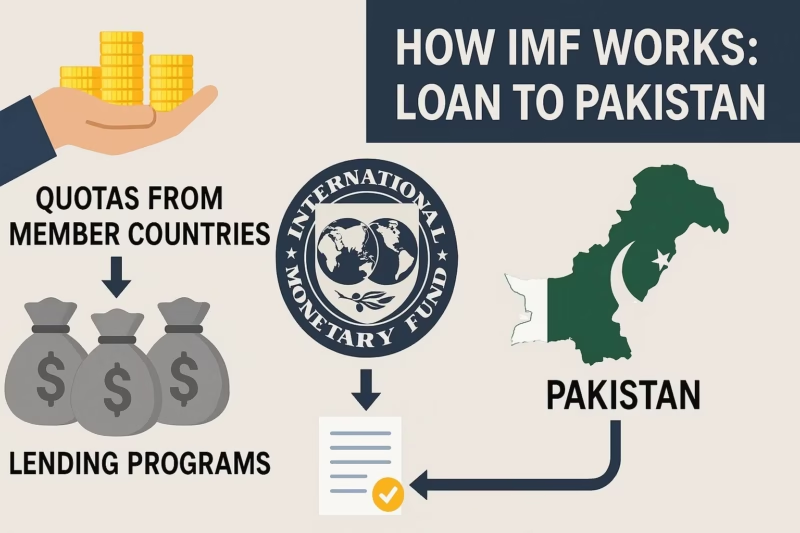

2. How IMF Works: Structure and Workflow

The International Monetary Fund was established in 1944 at the Bretton Woods Conference and became operational in 1945. It now has 190+ member countries, each contributing financially and having a vote based on their economic weight.

Core Objectives:

- Promote international monetary cooperation

- Facilitate balanced growth of international trade

- Provide financial support to countries with balance of payment problems

- Foster exchange rate stability

- Assist in poverty reduction (via concessional lending programs)

IMF’s Workflow in a Loan Program:

- Country Requests Help: A country facing a crisis (like low foreign reserves, high debt, inflation) formally approaches the IMF.

- Assessment and Negotiation: IMF economists assess the country’s economy and work with the government to draft a reform plan.

- Board Approval: The IMF Executive Board reviews and approves the program, including loan amounts and conditions.

- Disbursement: Funds are released in tranches based on the country’s progress on agreed reforms.

- Monitoring and Reviews: The IMF conducts periodic reviews before releasing each tranche.

- Repayment and Exit: Loans are typically short-to-medium term and must be repaid with interest.

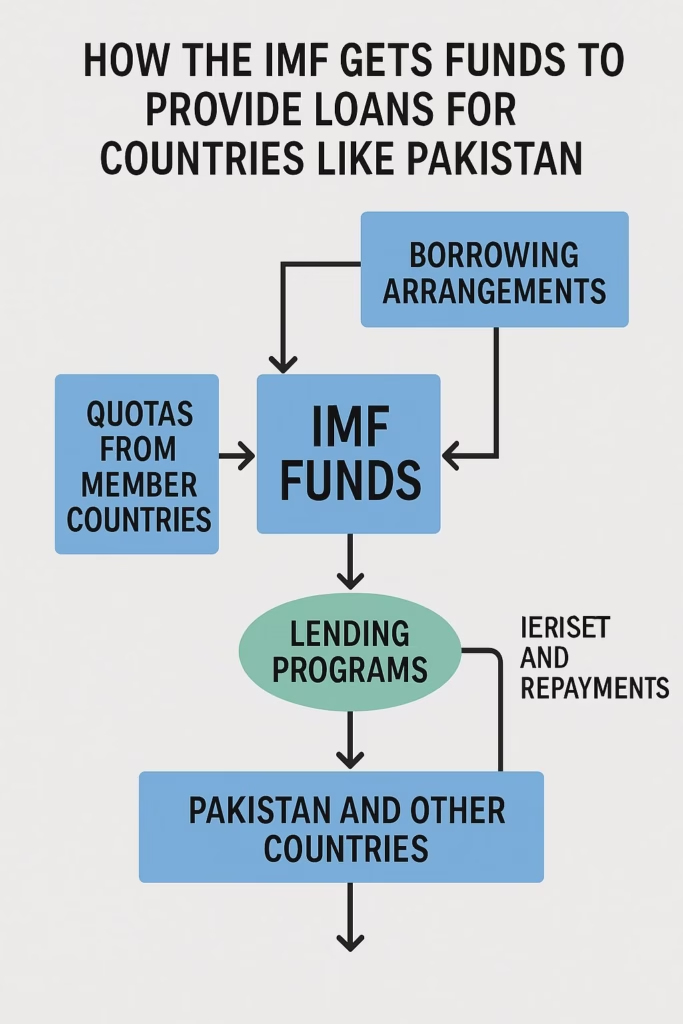

3. How IMF Works & Gets Funds to Lend to Countries Like Pakistan

A common misconception is that the IMF generates or prints money like a central bank. That’s not the case. The IMF’s funding comes from its member countries and from international lending arrangements.

a. Quota Subscriptions (Main Source of Funds)

- Every member country pays a quota, which is like a financial contribution.

- Quotas are determined based on the size of a country’s economy and its position in global trade.

- These quotas make up the financial base of the IMF, allowing it to lend to members in need.

- For example, the U.S. contributes the largest quota, followed by China, Japan, Germany, and the UK.

b. Borrowing Arrangements

- If quota funds are insufficient (especially during global crises), the IMF borrows additional funds through:

- New Arrangements to Borrow (NAB)

- General Arrangements to Borrow (GAB)

- These are agreements with member countries or groups of countries to provide emergency funds.

c. Loan Repayments and Interest

- As borrowing countries like Pakistan repay loans, the IMF recycles those funds to lend to other countries.

- Borrowers also pay interest, contributing to the IMF’s operating income.

4. Why Countries Like Pakistan Rely on the IMF

Pakistan, like several other developing nations, often faces issues such as:

- High trade deficits

- Debt servicing burdens

- Foreign exchange shortages

- Political instability and economic mismanagement

These problems make it difficult to meet international obligations or maintain investor confidence. In such times, the IMF acts as a lender of last resort, offering both money and technical expertise — but with strict conditions aimed at reforming the economy.

5. India’s Contribution and Role in the IMF

India has been a founding member of the International Monetary Fund since 1945 and plays an active role in shaping global economic policy.

Key Contributions:

- Quota Contribution: India’s current quota is 13,114 million Special Drawing Rights (SDRs), which gives it about 2.75% voting power in the IMF.

- Financial Support: India contributes to IMF funding through both quota and borrowing arrangements like the New Arrangements to Borrow (NAB).

- Policy Influence: As one of the top 10 contributors by quota, India has a say in important IMF decisions, including loan approvals and reforms.

- Technical Assistance and Training: India benefits from IMF training programs and also contributes experts and data to support the Fund’s work.

India’s growing economic stature means its role in the IMF is expected to become more significant in coming years, particularly as developing nations call for more equitable global representation.

6. Conclusion: IMF’s Dual Role as Banker and Policymaker

The IMF is more than just a bank. It’s a policymaker, economic advisor, and stabilizer for the global financial system. By offering conditional loans funded by its member states, the IMF helps countries like Pakistan navigate tough economic waters.

However, IMF loans come with strings attached — requiring tough reforms that are often politically sensitive. While controversial at times, these programs aim to bring long-term fiscal discipline and macroeconomic stability.

As Pakistan implements IMF-recommended reforms, the coming months will determine whether the assistance will deliver the intended outcomes — or merely postpone the next crisis.

Subscribe & Follow Money Advisor for more clear explanations, smart strategies, and real-world investment tips to help you grow your money confidently.

Read more about India’s Economic Slowdown in 2025: Impact on Investors & MF’s

📢 Disclaimer: “Money Advisor is operated by a SEBI-registered Mutual Fund Distributor (ARN-129675). The content on this blog is for informational purposes only and should not be considered as investment advice. Mutual Fund investments are subject to market risks. Please read all scheme-related documents carefully.”