The Rs. 1 Crore Myth:

For decades, Rs. 1 crore has been the magic number Indians aspired to save for retirement. It sounded massive — even luxurious. But in 2025, it’s just a modest sum, barely enough to support a family for a few years, let alone sustain a decades-long retirement.

Let’s unpack why this number is outdated, how inflation has quietly devalued your goals, and what a more realistic retirement plan looks like for today’s investors.

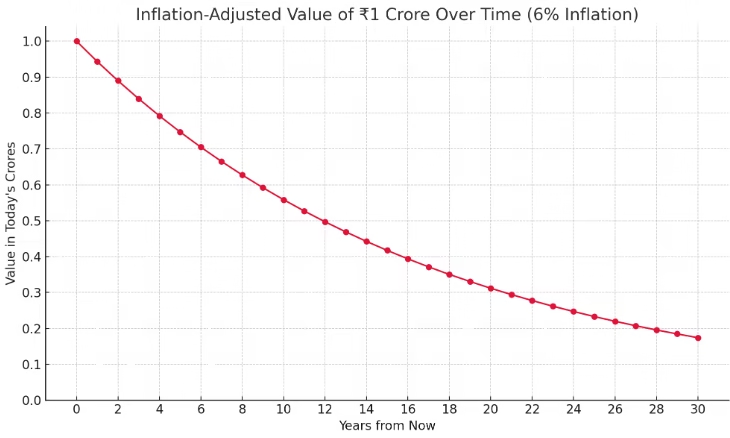

📉 The Real Enemy: Inflation

Inflation is the silent wealth destroyer. While your savings may be growing at a steady pace, inflation is constantly eroding their purchasing power. A Rs. 1,000 expense today could cost Rs. 1,800 in just 10 years with an average inflation rate of 6%.

Let’s visualize what happens to ₹1 crore over the years:

💥 Inflation-Adjusted Value of Rs. 1 Crore:

- In 10 years: Rs. 55.8 lakh

- In 20 years: Rs. 31.1 lakh

- In 30 years: Rs. 17.4 lakh

You read that right — by the time a 30-year-old retires at 60, their Rs. 1 crore savings will feel like just Rs. 17.4 lakh in today’s money. That’s not even enough to cover basic living expenses for more than a couple of years.

🏠 What Does Retirement Really Cost in India?

Let’s estimate a modest retirement lifestyle:

- Monthly expenses: Rs. 50,000 (today)

- Annual inflation: 6%

- Retirement duration: 25 years

To maintain Rs. 50,000/month expenses for 25 years (with inflation), you’ll need around ₹5-6 crore at the time of retirement.

Now imagine aiming for Rs. 1 crore. That would last you just 3–4 years — if that.

🧾 Breakdown: Where Does the Money Go?

- Healthcare: As you age, this becomes your largest expense. Private hospital bills, medications, check-ups, and health insurance premiums add up quickly.

- Lifestyle Maintenance: You’ll still want to travel, dine out, and enjoy life.

- Emergencies: Repairs, family issues, and economic shocks are inevitable.

- Inflation: Everything — from milk to medicine — gets costlier every year.

📊 Your New Retirement Goal: Rs. 5 Crore or More

Depending on your lifestyle, family responsibilities, and retirement age, a target of Rs. 5 to Rs. 10 crore is more realistic in 2025.

Here’s what different lifestyles might cost:

- Basic: Rs. 3-4 crore

- Comfortable: Rs. 5-6 crore

- Luxury: Rs. 8-10 crore

This assumes 25-30 years of retirement and accounts for medical inflation and rising costs.

💡 How to Reach Rs. 5 Crore: The SIP Route

Let’s assume:

- Target Corpus = Rs. 5 Crore

- Investment Horizon = 30 years

- Expected Return = 12% annually (via equity mutual funds)

SIP Calculation:

To reach Rs. 5 crore, you need to invest: Rs. 14,306/month consistently for 30 years.

This is the power of compounding. Small monthly contributions can lead to big results if you give them time.

🧮 SIP Growth Table (Rs. 14,306/month at 12% annual return)

| Year | Investment Made | Total Value |

|---|---|---|

| 5 | Rs. 8.58 lakh | Rs. 10.21 lakh |

| 10 | Rs. 17.16 lakh | Rs. 28.38 lakh |

| 15 | Rs. 25.74 lakh | Rs. 63.91 lakh |

| 20 | Rs. 34.32 lakh | Rs. 1.25 crore |

| 25 | Rs. 42.90 lakh | Rs. 2.29 crore |

| 30 | Rs. 51.48 lakh | Rs. 5.00 crore |

⚙️ How to Start:

- Start your Mutual Fund Investment: Contact us +91 9579751533.

- Choose a Diversified Equity Mutual Fund: Look for 4- or 5-star rated funds.

- Set a Monthly SIP Goal: Start with what you can afford. Even Rs. 5,000 is a great start.

- Increase SIP Annually: As your salary grows, increase SIP by 10–15% every year.

- Review Yearly: Adjust based on performance and goals.

📉 But What If You Start Late?

If you start at 40 instead of 30, your SIP needs almost double:

- Time Left: 20 years

- Target: Rs. 5 crore

- SIP Required: Rs. 33,290/month

If you start at 45:

- Time Left: 15 years

- SIP Required: Rs. 55,400/month

The earlier you start, the less you have to invest monthly. That’s the magic of compounding.

💬 Real-Life Example: Ramesh vs Suresh

- Ramesh (Age 25): Starts SIP of Rs. 8,000/month. By age 60, he has Rs. 2.8 crore.

- Suresh (Age 40): Starts SIP of Rs. 15,000/month. By age 60, he only reaches Rs. 1.9 crore.

Moral: Time > Amount. Start early!

🚨 Common Mistakes to Avoid:

- Targeting Just Rs. 1 Crore: It’s not enough anymore.

- Not Accounting for Inflation: Your Rs. 50,000/month expenses could become Rs. 2.87 lakh in 30 years.

- Stopping SIPs During Market Crashes: Stay invested. Volatility is normal.

- No Health Insurance: One medical emergency can wipe out savings.

- Delaying Investments: Procrastination is expensive.

🧠 Final Thoughts: Be Realistic, Not Romantic

Retirement is not about age — it’s about financial freedom. And Rs. 1 crore won’t buy that freedom anymore. It’s time to:

- Rethink your targets

- Adjust for inflation

- Embrace SIPs

Start today. Your future self will thank you.

📞 Stay Connected with Money Advisor

📧 Email: moneyadvisorin.fin@gmail.com

📱 Mobile: +91 95797 51533

🌐 Website: www.moneyadvisor.in

💡 Join our newsletter for exclusive budget templates, investment checklists, and expert Q&As—click “Subscribe” now and take your first step toward financial freedom!

📢 Disclaimer: “Money Advisor is operated by a SEBI-registered Mutual Fund Distributor (ARN-129675). The content on this blog is for informational purposes only and should not be considered as investment advice. Mutual Fund investments are subject to market risks. Please read all scheme-related documents carefully.”